Why All Credit Scoring is Not Created Equal

One of the most important factors a lender looks at when deciding what loan product is right for you is your credit score. Many people don’t know that your credit score can vary from lender to lender. The credit score you can look at for free online may be different from the one your mortgage lender pulls, which may be different from the one your auto loan lender pulls. But why is this? Shouldn’t your credit score always be the same number?

Let’s look more closely at what a credit score is and figure out why your score may be different from one lender to the next.

What is a credit score?

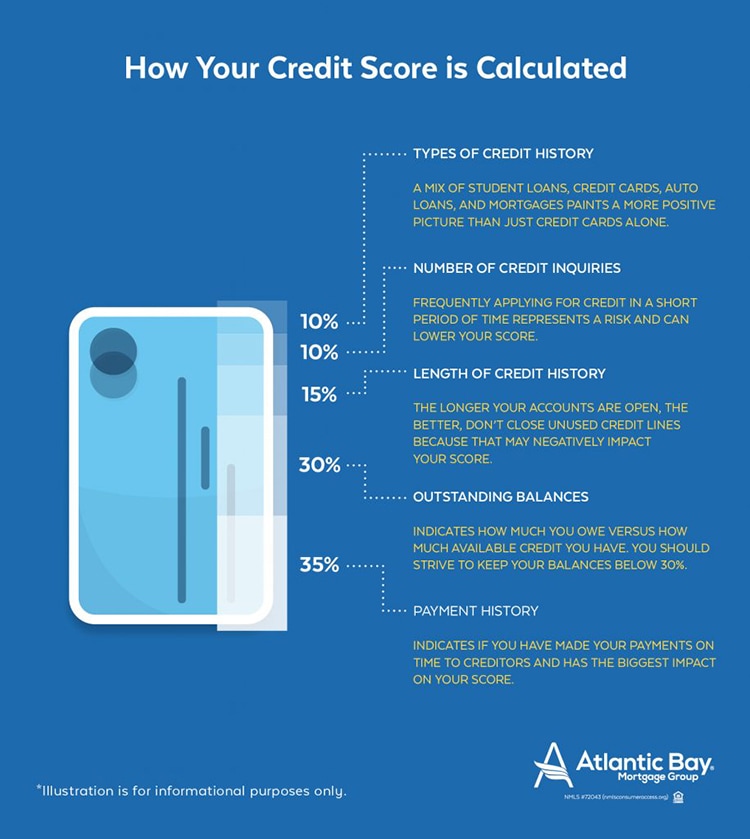

Let’s talk about your credit report. This is as a breakdown of your credit history — your outstanding debts, loans and monthly payments. It lists the facts that your lenders and creditors are required to report to the credit reporting agencies. All of the information on your credit report is translated into a number: your credit score. Your credit score pulls information from your credit report and reflects your credit worthiness. Your credit score determines whether you’re approved or denied for credit and also impacts your interest rate. Your payment history, outstanding balances, length of credit history, types of credit used, and number of credit inquiries all appear on your credit report. Each factor weighs into your credit score differently.

Why is a credit score important?

Your credit score plays a huge role in your finances. Credit scores are designed to predict risk, specifically whether or not you will be a responsible borrower.

Your score not only influences whether or not you’re approved for a mortgage loan, car loan, credit card, or other type of loan, it can also go into determining your interest rates and insurance prices. If you’re renting an apartment or house, your credit score can be key: sometimes your landlord will run a credit check before approving you as a tenant.

What causes your score to change?

As your financial habits change, so does your score. When you pay off a credit card or loan or make payments on time, your score may increase. On the other hand, maxing out a credit card, making a late payment, or missing a payment may cause your score to decrease. It can also hurt your score to have items on your credit report like bankruptcy, collections accounts, and negative court judgments.

Did you know that multiple credit inquiries can hurt your credit score?

When you apply for credit, you are also authorizing the lender to pull your credit score. For each credit inquiry, your score may decrease slightly, but for many borrowers, one credit inquiry won’t drastically affect your score. So, if you apply for a credit card, the credit inquiry will effect your credit score. If you take out a car loan, your credit score will reflect this additional inquiry. The good news is that credit inquiries of the same credit type only effect your credit score once, if done so during a short period of time. For example, if you get loan estimates from three or four different mortgage lenders, only one credit inquiry will appear on your credit report. This is so that you aren’t penalized for shopping around for the best interest rate and loan terms.

Why is your credit score different for different lender types?

Your score usually changes depending on what kind of lender you’re applying with. Different score models calculate your credit score in a way that is tailored to a specific loan type. There are auto loan scores, credit and bank card scores, mortgage loan scores, installment-specific scores, and personal finance-specific scores. The lender or creditor will typically choose the score model that will give them the most accurate picture of how you will repay that particular type of credit or loan.

There are a few different credit scoring models, but FICO® dominates the majority of the market of credit scoring agencies. Your three-digit credit score will generally range anywhere from 300 to 850. Basically, the higher your credit score, the better.

Do you have a good credit score? Credit scores fall into five categories, ranging from “poor” to “excellent.”

Your FICO® auto score may be different from the score that other lenders use, and is designed to specifically look at how likely you are to pay back that particular type of credit. Other industry-specific scores measure the same thing in their respective fields. So, your auto score will be weighed more heavily by how you’ve paid back car loans in the past than other credit models.

Another FICO® score specific to its industry is the FICO® bankcard score, which gives more weight to past credit card use and payment history.

How are credit score for mortgages calculated?

Mortgage lenders often use a more strict scoring formula. They’re more concerned with the likelihood you’ll pay back a home loan, not a credit card or car. Mortgage companies typically take into account three different agency scores — Equifax, Experian, and TransUnion — which may each yield a slightly different score.

Now that you know that not all credit scores are calculated the same way, make sure you communicate with your mortgage banker so that you understand what’s important to a lender when applying for a home loan.