Fannie Mae Credit Updates Make Home Buying More Accessible

WHAT YOU'LL LEARN

Why credit poses a challenge for low-income renters

How consistent rent payments can build a bigger credit profile

How multiple borrowers can benefit from new credit score analysis

WHAT YOU'LL LEARN

Why credit poses a challenge for low-income renters

How consistent rent payments can build a bigger credit profile

How multiple borrowers can benefit from new credit score analysis

Homeownership is the American dream because it provides stability, community, and a path to building wealth. But for many credit-challenged borrowers, insufficient credit history and minimum credit score requirements have historically posed huge obstacles. However, beginning Sept. 18, 2021, Fannie Mae, a government-sponsored enterprise that makes mortgages available to low- and moderate-income borrowers, will implement two new and exciting ways to support more homeownership opportunities for underserved borrowers:

Consistent rent payments can count toward loan applications

Average credit scores for multiple borrowers will be considered for eligibility

Let’s jump into each of these and discover how these new updates could work to significantly close the homeownership gap in America

Consistent Rent Payments Boost Eligibility

Historically, monthly rent payments were not calculated into a borrower’s credit history or payment ability, but beginning in September, recurring monthly rent payments of more than $300 will be reviewed. In other words, if you are a first-time homebuyer and have paid your rent on time every month for 12 consecutive months, that history can provide a major boost to your loan eligibility.

In fact, in a recent sample of Fannie Mae applicants who had not owned a home in the past three years and did not receive a favorable recommendation through Fannie Mae’s Desktop Underwriter® (DU®), 17% could have received an Approve/Eligible recommendation if their rental payment history had been considered. The theory behind this update is that if someone pays rent consistently, they will likely pay their mortgage consistently, too.

Fannie Mae’s Desktop Underwriter® (DU®)

Desktop Underwriter, or DU, is Fannie Mae’s automated mortgage underwriting system. Using a computer algorithm, DU takes your financial information entered by your lender and automatically analyzes your credit, income, and debt to determine whether you qualify for a loan.

For many households, rent is the single-largest monthly expense. There is absolutely no reason timely payment of monthly housing expenses shouldn’t be included in underwriting calculations. With this update, Fannie Mae is taking another step toward understanding how rental payments can more broadly be included in a credit assessment, providing an additional opportunity for renters to achieve the dream of sustainable homeownership.

Sandra L. Thompson, Federal Housing Finance Agency (FHFA) Acting Director

Even better, your credit score will not be affected, and rent payment history will only be used to help eligible homebuyers qualify for mortgage credit. Only positive rent payments will be considered to improve eligibility. In other words, if your bank data shows missed or inconsistent rent payments, these will not negatively affect your ability to qualify for a loan sold to Fannie Mae.

A New Look at Credit Scores

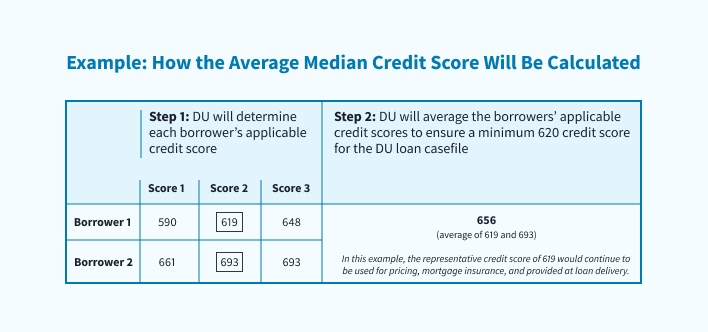

To help more borrowers achieve homeownership, Fannie Mae is updating the credit score used by DU in the eligibility assessment for multiple borrowers. DU currently evaluates credit scores to ensure compliance with Fannie Mae’s 620 minimum score requirement. Typically, when an application has more than one borrower, the lower middle of the “applicable scores” is used. So, if a husband has a 619 as the “middle” of his three credit scores, and the wife has a 693, DU would only recognize 619. But with the new update, on applications with multiple borrowers, DU will use an average median credit score—in this case, 656. This innovation helps solidify your eligibility for loan programs.

Credit: Fannie Mae Desktop Underwriter/Desktop Originator Release Notes DU Version 11.0 Sept. Update Aug. 11, 2021

Fannie Mae’s latest changes can significantly help buyers previously inhibited by credit limitations have a better chance at homeownership. If you have questions about your credit or are ready to apply for a loan, contact a Mortgage Banker today!

The views and statements expressed are deemed reliable as of the publish date indicated and may not be accurate or reliable at any future date. The views and statements provided are those of the author. Discussions regarding any financial information provided are not intended as individual recommendations and do not reflect the views or advice of Atlantic Bay Mortgage Group, L.L.C. The views expressed are subject to change at any time in response to changing circumstances in the market. Atlantic Bay Mortgage Group, L.L.C. disclaims any obligation to publicly update or revise any views expressed or information given. Loan programs may change at any time with or without notice. Information deemed reliable but not guaranteed. All loans subject to income verification, credit approval and property appraisal. Not a commitment to lend. Atlantic Bay Mortgage Group, L.L.C. NMLS #72043 (nmlsconsumeraccess.org) is an Equal Housing Lender. Located at 600 Lynnhaven Parkway Suite 203 Virginia Beach, VA 23452.

To read the entire Fannie Mae September 18, 2021 Release Notes, visit https://singlefamily.fanniemae.com/media/28331/display