What's Happening With Open Houses?

WHAT YOU'LL LEARN

Defining how an open house works

How to tour homes virtually

WHAT YOU'LL LEARN

Defining how an open house works

How to tour homes virtually

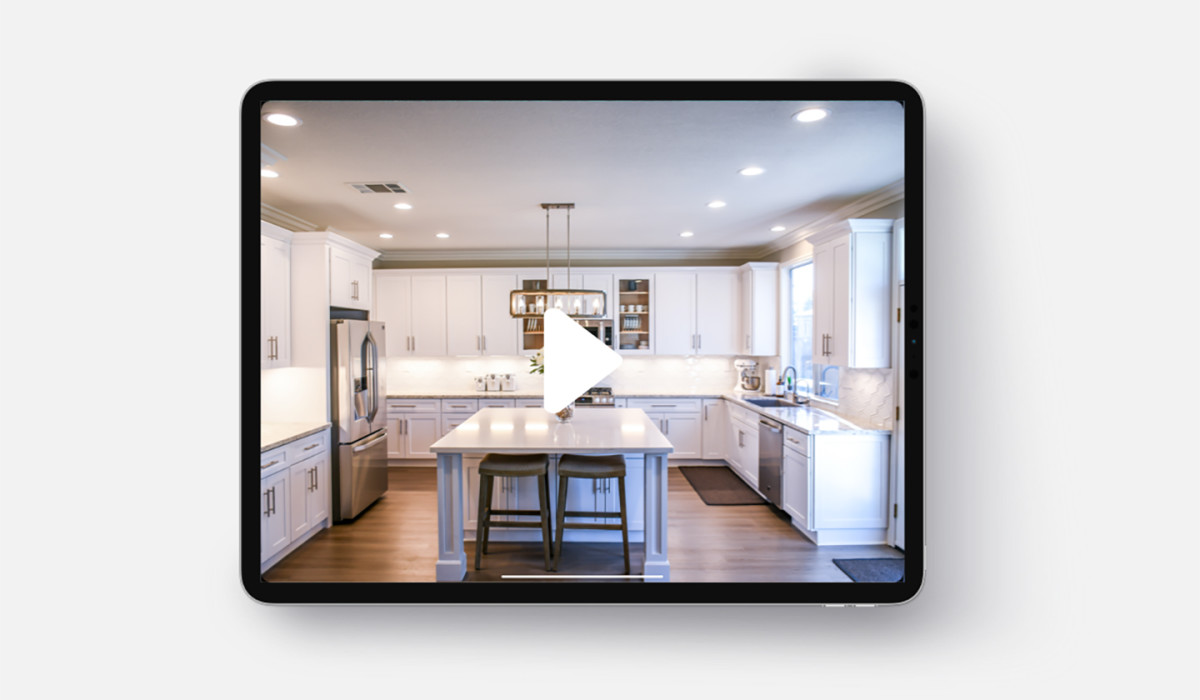

The Spring real estate market has arrived and the transformation of technology for virtual open houses and house tours are quickly becoming a popular option for buyers. So, what does this mean to you on your homebuying journey? While we are all adapting to certain restrictions based on the current times, everything done virtually has become somewhat of a “new normal.” Atlantic Bay Mortgage Group ® understands how important the homebuying process is and make no mistake, we will be there for you every step (or click) of the way.

How does this work?

By using tools such as FaceTime, Lifesize, Zoom, Facebook or even Microsoft teams enables your agent to schedule a live walkthrough of homes in your area. By doing so you can attend an open house or virtually walkthrough a home that you’ve been dreaming about.

Taking a tour of your potential dream home

Perhaps you will find yourself unsure of having that “this is the one” feeling while you’re touring a home from behind a computer screen. Rest assured your agent will provide your family with a virtual open house or even just an interactive tour through your prospective home and will be there to answer any questions you might have on the way.

Here are some ideas to prepare yourself for your virtual open house:

Prepare a list of questions ahead of the tour, by going through the images (if available) on websites like Zillow, Trulia or Realtor.com.

Keep an open discussion going throughout the tour.

Take as long as you need in each room to really get the full effect.

Think about how your furniture will fit, or how you will bring those four walls to life.

Times are changing. We’re able to lead you through the homebuying and lending journey virtually from the start of pre-qualification to closing on your new home. Our mortgage bankers are ready to answer any of your questions to ensure peace of mind for you and your family even when you might not be used to this “new normal.”