Yes, You Can Enjoy Life While Saving to Buy a Home

So, you’re ready to settle down and buy a home — but maybe you’re worried your social life and day-to-day enjoyment might head south while you take some time to save up your dollars and cents. Don’t throw in the towel just yet — you can still enjoy life while you prepare to take the next step on your journey toward homeownership. Here’s how.

Decide how much you need to save

Let’s get the hard part out of the way – calculating the total sum of money you want to stash away to put toward a new home. While it may seem like a hard pill to swallow, making an educated and well-thought out decision about how much you feel comfortable paying monthly on a mortgage, and how much you’d like to put down will help you take the first step toward achieving your savings goal. After all, as the saying goes, “a goal without a plan is just a wish.”

Meet with a lender: To accurately determine how much home you can afford, it’s a good idea to engage with a lender early in the process to get a clear understanding of all the types of loan programs out there and how much you’ll need to set aside for a realistic down payment.

Chat with a real estate agent: It’s also a good idea to do your homework in terms of the current real estate market. The best way to do that is by taking the time to find a fantastic agent. He or she can give you an idea of whether it’s a buyer or seller’s market (which could determine how much a seller will contribute towards your closing costs, and paints a picture of how competitive the market is).

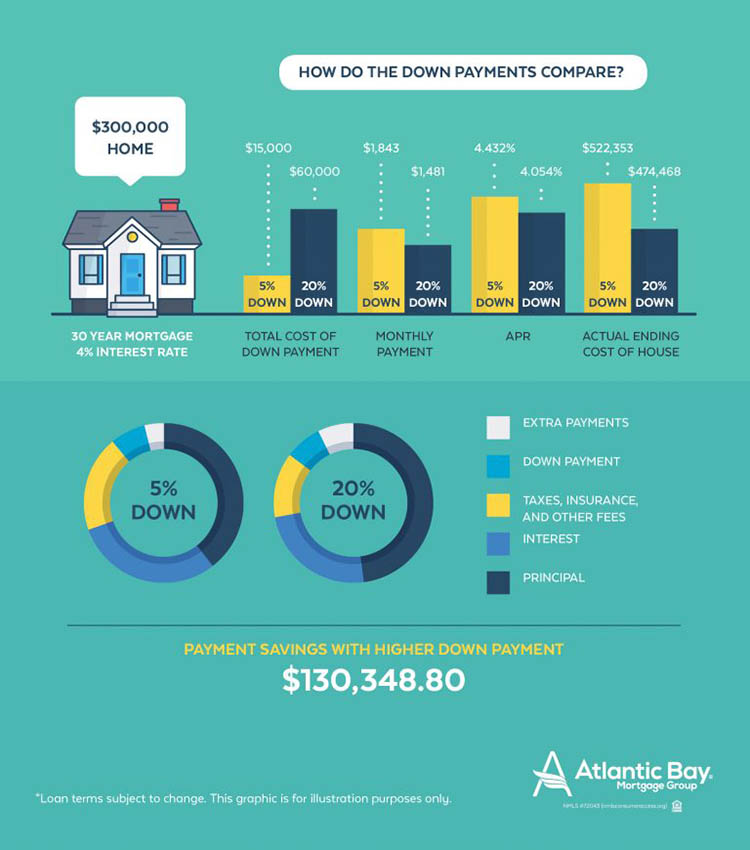

Understand the impact of a down payment

With a [variety of loan programs to choose from, you may find that you don’t necessarily need to put down the full 20% of the purchase price in order to score the right home — which is great news, if the thought of saving 20% is daunting!

It’s worth noting, though, that putting less than 20% down means you’ll likely need to pay private mortgage insurance (PMI).

It’s important to weigh the pros and cons here because it could make sense to take extra time to save up the full 20%, depending on your situation and goals.

There are some exceptions like VA loans, for example, that don’t require a down payment, don’t have PMI, and are appealing to all parties involved because it’s government-insured.

Save money without sacrifice

Yes, sometimes saving money does mean sacrificing certain luxuries in life right now for a reward later down the road. However, it doesn’t mean you have to go into hiding when you decide it’s time to start saving up for a home. Don’t worry — you just may need to strategize a bit while you put money away for a down payment.

Shop But Don’t Drop Your first thought might be ‘Oh, I have to give up all of my favorite things: coffee, binge worthy TV shows, working out – my life is over!’ What if, instead of giving up the simple joys in your life, you found ways to get creative and save while doing it?

Got cable? Look for ways you can trim your bill, whether it’s dropping your package down a notch, switching to a different TV provider – or even cutting the cord and switching to a streaming service provider.

Cell phone bill getting you down? For many, mobile phones have replaced home phone lines, so ensuring you have a strong connection and a good data plan are key. However, you may find that switching providers can help you save a big chunk of change each month.

Gym membership fees trimming your bank account? Consider working out with friends to save big. Go out for a run or host a workout at you or a pal’s place using workout DVDs, a streaming service you already have, or at-home workout books. You don’t have to skimp on getting fit!

Need your daily caffeine fix? You don’t have to give it up completely! Perhaps you can cut back from a $5 latte to a $2 cup of coffee with milk – or better yet, create a custom coffee bar at home and make fancy drinks for a fraction of the cost.

When You Spend, Also Save

Sometimes, you just get the urge to buy something. That’s human nature. And while, on paper, it might make sense to swear off any discretionary spending during the process of saving for a home – it’s probably not realistic. That’s where this rule comes into play: Every time you purchase something that isn’t a ‘necessity’ (whether it’s clothing, shoes, electronics, etc.), match the dollar amount you spent and make a contribution directly to your savings account.

You’ll be surprised at how much you can save by following this process – and it just might make you rethink where and how you’re spending your money, too.

Don’t Be Afraid to Extend Your Timeline

It’s never a good idea to rush into the home buying process, and this is especially true if you’re in the process of saving for a down payment. Maybe you were aiming to save 20% but it feels like it’s taking forever, or perhaps you planned to save 10% but quickly met your goal and want to keep going. In either scenario, giving yourself more time and not holding yourself to a specific timeline can pay off.

Remember, putting a bigger down payment on a home could cut down on your monthly mortgage payment – possibly eliminating PMI. Or, it could give you the opportunity to buy more house.

When you’re ready to begin the home buying process or simply want to learn more about mortgage options available to you, contact a mortgage banker to get the advice you need.